When looking for possible investments, most investors choose suburban or urban areas. There are more people here, so you are more likely to find renters. You have more support businesses and public services — ten electrical contractors to choose from, instead of two.

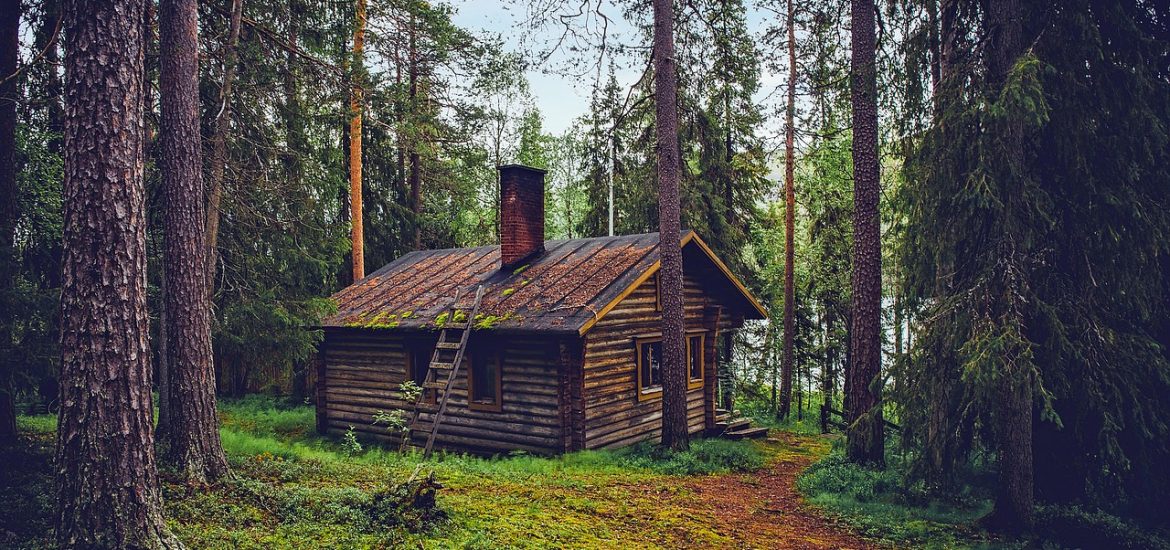

But there are also several advantages to investing in rural property. It is often less expensive to build on and maintain rural lots, taxes are often lower, and you have the chance to partner with industries (like agriculture and large manufacturing) that you would be unable to find in urban areas.

Listed below are four tips for a real estate investor looking to succeed in rural markets.

Make your mark

Rural markets are smaller, so it is much easier to stand out. Use this to your advantage. If you spend enough time in the area, people will recognize you. You will also have a disproportionate impact on the community, since you’re one of the few games in town.

However, you also need to establish yourself and your business as a presence in the area, otherwise people may not trust you. Rural communities tend to be more tight-knit than urban ones. Attending, and even sponsoring, community events is surefire way to build trust and goodwill.

In order to feel confident enough to do business with you, the people in your adoptive community need to know that you can be trusted as a resource for them.

Know your niche

Rural areas have fewer needs than more populous areas, which can be tricky for the investor. There’s no point in picking a site for a huge warehouse if there aren’t enough businesses to fill it.

Rural areas are also often less connected than urban areas. If you look at North Carolina land for sale, for instance, you will notice lots of large-acre tracts in the mountains. Great for a clutch of vacation homes, not so great for heavy manufacturing and the huge trucks that come with it.

Look to the long-term

Rural real estate has its ups and downs like any other, but due to demand being low in rural areas, it can take a long time for prices to bounce back after a downswing. Many real estate pros advocate a “buy and hold” strategy when it comes to rural real estate investment, rather than trying to flip it.

This strategy is especially advantageous if you bet your money on a plot that can generate reliable long-term profits. Timberland and farmland investments often pay off over decades, rather than quarters. Though they do not generate purely passive income by any means (they still require management), farmland, timberland, and even “raw land” can create rock-steady income streams.

Go for growth

As a million country songs have lamented, more and more farmland vanishes every year. Modern Farmer estimates that we lose 3 acres per minute. Cities adjacent to rural areas are experiencing some of the fastest growth rates in the country. Sacramento, California, as an example, is located in the agricultural Central Valley, but grew by over 25,000 people between 2017 and 2018.

Buying rural land in an area like metro Sacramento is a smart long-term move. These types of investments often call for a multi-year “buy-and-build” strategy, where you buy a plot, partner with a builder, and wait a year or two for the city to come to you.

If you have a penchant for building, you can start by entering “sell my house Sacramento” in the search bar and looking into the endless sprawl of cities into the soon-to-be suburban spaces that surround them.